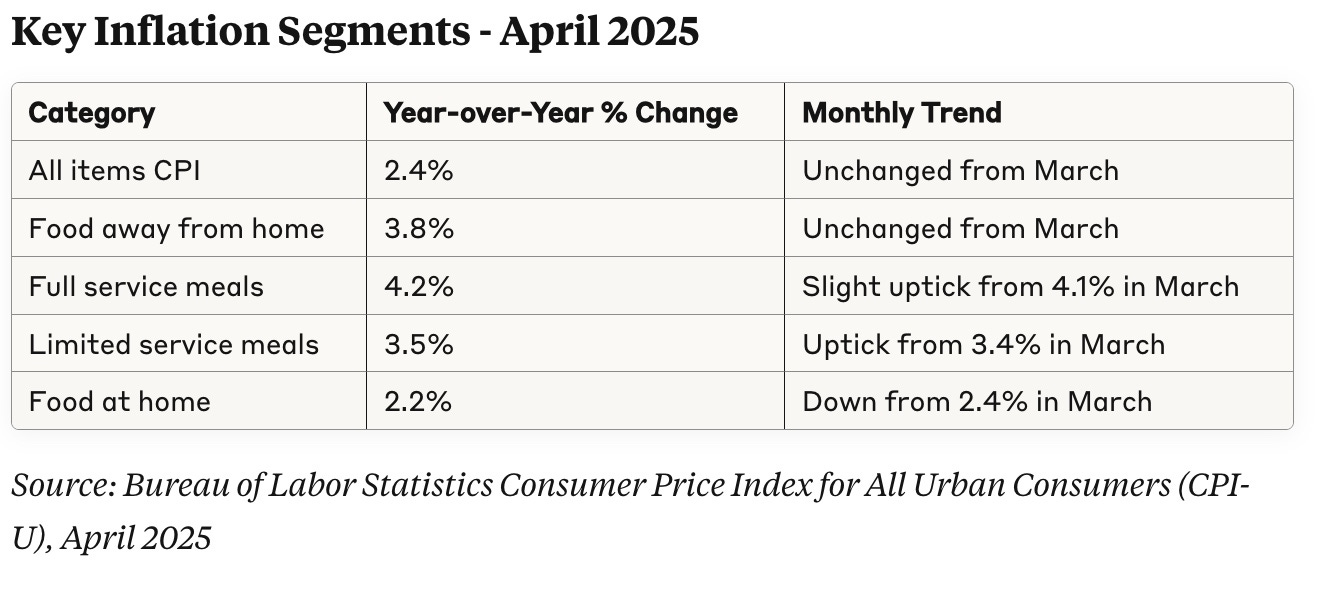

Restaurant CPI held steady at 3.8% in April, unchanged from March levels, but the underlying dynamics tell a more complex story. Full-Service restaurants edged up to 4.2% (from 4.1% in March), and Limited Service establishments saw an increase to 3.5% (from 3.4%). This marks the third consecutive month where Full-Service restaurants are outpacing Limited Service operations—a reversal of the historical pattern that is worth noting.

The headline CPI remained anchored at 2.4% for the second consecutive month, suggesting some stabilization in broader price pressures. However, restaurant inflation continues to run at nearly 60% above headline levels, highlighting the persistent structural challenges facing our industry.

The Divergence Story Continues

There is a divergence between grocery deflation and restaurant inflation persistence. Food at home prices decelerated to 2.2% in April (down from 2.4% in March), providing consumers relief at the supermarket checkout. Restaurants continue to grapple with elevated input costs and labor pressures that can't be easily passed through in the current demand environment.

This grocery-restaurant gap creates a behavioral dynamic. When consumers see lower prices at the grocery store but higher prices at restaurants, it encourages substitution toward home cooking—particularly among price-sensitive segments.

Looking Forward: Strategic Implications

For restaurant operators, April's data reinforces several key strategic considerations:

Pricing Strategy: The continued divergence between full-service and limited-service inflation suggests different pricing elasticity curves across segments. Operators must carefully calibrate price increases against traffic risk.

Market Positioning: Regional variations indicate that national chains may need increasingly localized pricing strategies to remain competitive.

Consumer Communication: With grocery prices moderating while restaurant prices remain elevated, operators face a growing challenge in communicating value propositions.

The Road Ahead

As we move deeper into 2025, the restaurant industry faces a complex environment where traditional economic relationships seem to be breaking down. The persistent elevation of restaurant inflation above headline levels, combined with moderating grocery prices, creates ongoing pressure on consumer dining frequency.

The key question isn't whether restaurant prices will moderate—it's whether operators can successfully navigate the transition period while maintaining market share and profitability. The data suggests we're in for continued volatility as these structural adjustments play out.

For now, the industry remains caught between the rock of persistent cost pressures and the hard place of increasingly price-sensitive consumers. April's numbers suggest this tension isn't resolving quickly—making strategic agility more critical than ever.

May 2025 Update

The May 2025 CPI data shows continued regional variation in inflation rates:

National and Regional CPI (Year-over-Year)

U.S. city average: 2.4%

Northeast: 2.8%

Midwest: 2.4%

South: 2.0%

West: 2.4%

Selected Metro Areas (Year-over-Year)

San Diego: 3.8%

New York metro: 3.4%

Chicago: 3.3%

Los Angeles: 3.0%

Boston: 3.0%

The South region continues to show the lowest inflation at 2.0%, while the Northeast maintains the highest at 2.8%. Monthly changes from April to May 2025 were modest, with the national average increasing 0.2%.